I'd like to share a video from one of the most brilliant investing minds of our time. If there's any doubt, allow me to share his

documented track record. The following predictions can be found on his

The Underground Investor blog. J.S. possesses an extremely deep understanding of real world economics, and I follow his information religiously. Here are his past predictions.

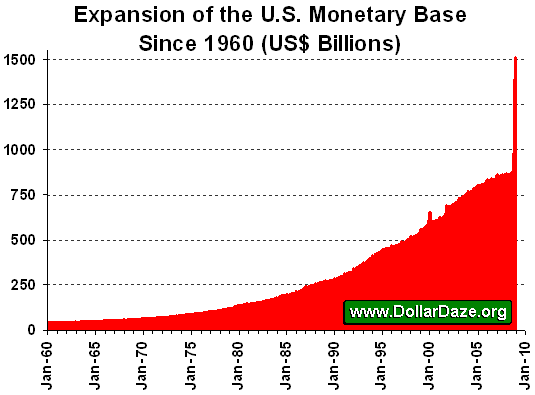

June 2006: “The dollar has to weaken not a little, but considerably, for the massive U.S. trade deficit to close considerably. And a stronger U.S. dollar of course makes this less likely to happen (a stronger dollar means that U.S. goods become more expensive for foreign countries, so U.S. exports would be likely to decline). However, because American individuals are burdened with debt as well, Bernanke’s hands are tied as to the number of times he can continue to raise interest rates without causing an economic recession. In the early 2000’s many American’s overextended their credit, taking advantage of historically low interest rates to buy huge houses with low mortgage payments that were really over their budget.”

Outcome: The sub-prime mortgage fiasco and currency fiasco that we warned about became a reality. Within just one year, the U.S. dollar lost 15% against the NZ dollar, 5% against the Sing, and 16% against the Thai baht not to mention huge losses against major currencies like the Euro and Pound Sterling.

August 16, 2006: “Over seven and a half years, if your portfolio has tracked the S&P 500’s index as some 97% of U.S. professional money managers aim to do, you have about the same amount of money you had seven and a half years ago – only with the rapid devaluation of the dollar, your same amount of dollars buys much less today, so in all actuality, tracking the index has lost you money. That’s a whole lot of waiting for a whole lot of nothing. And that’s the good news. The bad news is, as of 2006, the U.S. stock market’s performance will likely become even worse for the rest of this decade.”

Outcome: When I made this prediction, every single one of my former colleagues in the investment industry with whom I discussed this prediction laughed (and some quite literally, laughed out loud) at this prediction. In fact I remember one investment industry professional stating that the probability of the S&P 500 closing lower than its August 16th, 2006 level at the end of the decade was ZERO, even if one took the effects of inflation into account. Today, at the near end of this decade, four years after

my prediction, the nominal S&P 500 level stands at 1,183.08, down from its nominal level of 1,295.43 on August 16, 2006. Factor in real inflation rates of 10% to 13% between 2006 and 2008 and more recent inflation rates of 8% to 9% (as calculated by shadowstats.com) and the REAL losses in the S&P 500 in the past four years become quite substantial.

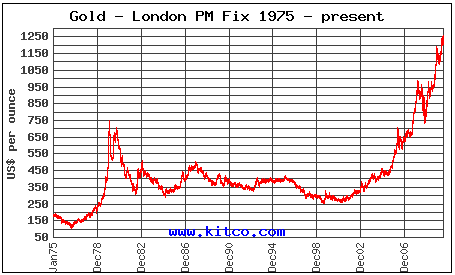

September 6, 2007: “Increased volatility in stock markets will occur as $370 billion in sub prime mortgages re-set to higher rates, starting with $50 billion in September and $30 billion every month thereafter for the next 18 months to 2 years. Triple-digit losses in the Dow during single day trading sessions will become commonplace…2007, and possibly into very early 2008, will present the last opportunity to buy gold at less than $700 an ounce, but not without some volatility in between….We will see a strong rebound in the U.S. markets after a deepening and scary correction. The rebound will be manufactured again by the U.S. Treasury with the help of the U.S. Federal Reserve.”

Outcome: Although it’s hard to think back this far, on September 6, 2007, gold was trading at $685 an ounce. I presented the above opinions at the Pan Pacific Hotel in Asia at an investment forum, after which several investment professionals approached me and told me they believed that gold was too expensive and that they would wait until gold dropped below $600 an ounce again before they would consider buying. These professionals may still be waiting to buy. Gold rose from the $680 level in September to over $1,000 a troy ounce by March of 2008. The London PM fix never closed below $700 an ounce since then, even when the Fed Reserve engineered its now infamous attack against gold prices in October of 2008. Triple-digit losses in the DJIA happened almost daily or several times a week to open January of 2008 just as I had predicted.

November 16, 2007: “With financial and housing stocks slumping and big corrections in many major global stock markets, much of the easy money shorting markets has already been made, though more will come in the future. I think mutual fund companies are the next best bet for now. As the crisis widens, I expect outflows from mutual funds to occur. There have been some funds whose share price has defied current trends and those would be the best bet, Janus Capital among them (JNS). Janus has a trailing 12-month P/E of more than 40 versus the 29 of its peers. But there are others as well.”

Outcome: During the next four months, Janus Capital’s share price plummeted more than 38%.

January 2008: “We can be assured that in 2008, that the destruction of monetary value in both Europe and the United States will occur…when smart investors finally realize that no fiat currency is safe, I believe that investors (at least the savvy one) will begin to dump the Euro and the Pound as well.”

Outcome: In August and October of 2008, both the Euro and Pound plummeted in value, both losing about 25% in value in a very short time period.

July 22, 2008: “The global financial crisis is not under control and becoming better as [bankers and gov’t officials] continually publicly state. My downside target for Fannie Mae right now would be $4 a share.”

Outcome: Though U.S. Treasury Secretary Henry Paulson stated that “[Fannie Mae’s] regulator has made clear that they are adequately capitalized,” Fannie Mae dropped from $19 a share at the time I made my statement to near nothing (turned out my $4 a share prediction was too optimistic!). On September 10, 2007, the US Gov’t nationalized Fannie Mae.

March 11, 2008: “If you are an “old-school” person that believes in the sacredness of and credibility of banking institutions and view Money Market Funds as “safe”, I urge you to re-assess that belief right now. Many Short-Term MMFs invest heavily in Asset Backed Commercial Paper (ABCPs), many of which are backed by these very shady Mortgage Backed Securities. If the MBS’s go belly up, so does the ABCP, and your MMF, which everyone believes can never lose value, WILL lose value.”

Outcome: It took a little bit longer for this prediction to come to fruition, which of course, opened the doors for people to state I was crazy once again. On September 16, 2008, one of the first and largest US money market funds put a seven-day freeze on investor redemptions after the net asset value of its shares fell below $1. Shortly thereafter, two more money market funds also announced their inability to redeem the fund at a net asset value of $1.

March 6, 2009: I stated to my

Platinum clients “

now is a good time” to add

MORE to physical silver holdings. I further emphasized that this was a long-term play and that while

“it is always impossible to determine the timeframe for exactly when these great leaps higher in price will occur, [this] is always why I seek what I feel are low-risk, high-reward entry prices.”

Outcome: Since then, silver has risen 78% from $13.12 an ounce to $23.31 an ounce

.

May 31, 2009: I stated to my clients “It’s time to be very cautious with your precious metal stocks”. I explained the reasons why I believed danger was imminent (reasons that have to do with gold price suppression schemes) and why the time was ripe to apply tight trailing stop losses on PM stocks.

Outcome: The AMEX gold bugs index (HUI) plummeted from 398.06 on the first day after I issued the bulletin to 318.27 in the next 15 trading days, a 20% rapid fall.

Later, I'll post Bernake's predictions. Not surprisingly, they're laughable.

Anyways, without further adieu, J.S. Kim's recent video post.

Here's another way to judge the true rate of inflation using the U.S. Postal Service stamp price statistics. According to the government, the cost of a postage stamp reflects only true cost-of-living increases, since the USPS is not-for-profit, right?

Here's another way to judge the true rate of inflation using the U.S. Postal Service stamp price statistics. According to the government, the cost of a postage stamp reflects only true cost-of-living increases, since the USPS is not-for-profit, right?